additional net investment income tax 2021

These might be subject to NIIT if they have undistributed net investment income. All You Need to Know about the 38 Medicare Net Investment Income Tax how Pres.

Seven Federal Tax Areas Businesses Should Be Focusing On During Year End Planning

Individuals estates and trusts with income above specified levels own this tax on their net.

. These are the updates for 2021. See more about calculating your net investment income. E-file online with direct deposit to receive your tax refund the fastest.

Income generated by certain types of businessesspecifically limited partnerships. TurboTax is the easy way to prepare your personal income taxes online. In general net investment income for purpose of this tax includes but isnt limited to.

Under current law limited partners who materially participate in a. 1 - The 38 tax is in addition to the tax rates for high income individuals. For estates and trusts use undistributed net investment income The amount by which your MAGI exceeds the relevant amount listed above.

That means you could pay up to 37 income tax depending on your federal income tax bracket. Your net investment income which is your investment income minus expenses. April 28 2021 The 38 Net Investment Income Tax.

The second tax faced by high-income taxpayersthe net investment income tax NIITis a 38 percent tax on qualifying investment income such as interest dividends capital gains rents royalties and passive income from businesses not subject to the corporate income tax. Biden Will Expand Who Pays It. Amount of your modified AGI in excess of the threshold amount.

Try it for FREE and pay only when you file. For estates and trusts the 2021 threshold is 13050 Definition of Net Investment Income and Modified Adjusted Gross Income. TurboTax online makes filing taxes easy.

Your net investment income is less than your MAGI overage. The tax will be on the lesser of these. Qualifying widow er with a child 250000.

Social Security OASDI only 137700. The tax is calculated by multiplying the 38 tax rate by the lower of the following two amounts. Those rates currently range from 10 to 37 depending on your taxable income.

Choose easy and find the right product for you that meets your individual needs. April 28 2021 The 38 Net Investment Income Tax. But youll only owe it on the 30000 of investment income you havesince its less than your MAGI overage.

According to an April 28 2021 Congressional Research Service Report the Joint Committee on Taxation estimates that the net investment income tax will raise approximately 275 billion of revenue in 2021 and that the majority of the tax is paid by higher-income households see Congressional Research Service The 38 Net Investment Income Tax. Your additional tax would be 1140 038 x 30000. For virtually all labor and capital income that is derived from the activities of sole proprietorships general partnerships and C corporations businesses that are subject to the corporate income tax and that is above the income thresholds the combination of Medicare-related taxes and the NIIT results in a uniform 38 percent marginal tax rate.

To see what rate youll pay see What Are the Income Tax Brackets for 2021 vs. If your modified AGI is more than the threshold amount and you have net investment income youll be subject to the 38 tax. A the undistributed net investment income or B the excess if any of.

Surtax on Net Investment Income. 1 2013 individual taxpayers are liable for a 38 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified adjusted gross income exceeds the statutory threshold amount based on their filing status. Overview Data and Policy Options Since 2013 certain higher-income individuals have been subject to a 38 unearned income Medicare contribution tax more commonly referred to as the net investment income tax NIIT.

The adjusted gross income over the dollar amount at which the highest tax bracket begins for an estate or trust for the tax year. 2021 Federal Income Tax Brackets. When you trigger the high-income threshold for the Medicare surtax then you could pay 38 29 Medicare plus 09 surtax on some portions of your income.

Married filing jointly 250000. Youll owe the 38 tax on the lesser amount. Modified adjusted gross income over a certain.

Your net investment income. The net investment income tax an additional 38 surtax. The statutory authority for the tax is.

Lets say you have 30000 in net investment income and your MAGI goes over the threshold by 50000. Youll owe the 38 tax. Net investment income for the year.

An additional 09 Medicarehospital insurance tax for a total Medicare portion of 38 is assessed on self-employment income exceeding 200000 250000 for married couples filing joint returns 125000 for married individuals filing separate returns. A married couple with a net investment income of 240000 and modified adjusted gross income of 350000 will pay 38 on the lesser amount of the 240000 of net investment income or 350000 250000 100000 of modified adjusted gross income yielding an NIIT of 100000 3 8 3800.

What Is Investment Income Definition Types And Tax Treatments

Real Estate Experts Hail Rbi S Decision On Interest Rates Real Estate Estates Bank Of India

What You Need To Know About Capital Gains Tax

What Is The Net Investment Income Tax And Who Has To Pay It Bankrate

Biden Budget Biden Tax Increases Details Analysis

Net Investment Income Tax Schwab

9 Facts About Pass Through Businesses

Like Kind Exchanges Of Real Property Journal Of Accountancy

Form 8615 Tax For Certain Children With Unearned Income Jackson Hewitt

What You Need To Know About Capital Gains Tax

Tax Calculator Estimate Your Income Tax For 2022 Free

What You Need To Know About Capital Gains Tax

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

Taxation Of Investment Income Within A Corporation Manulife Investment Management

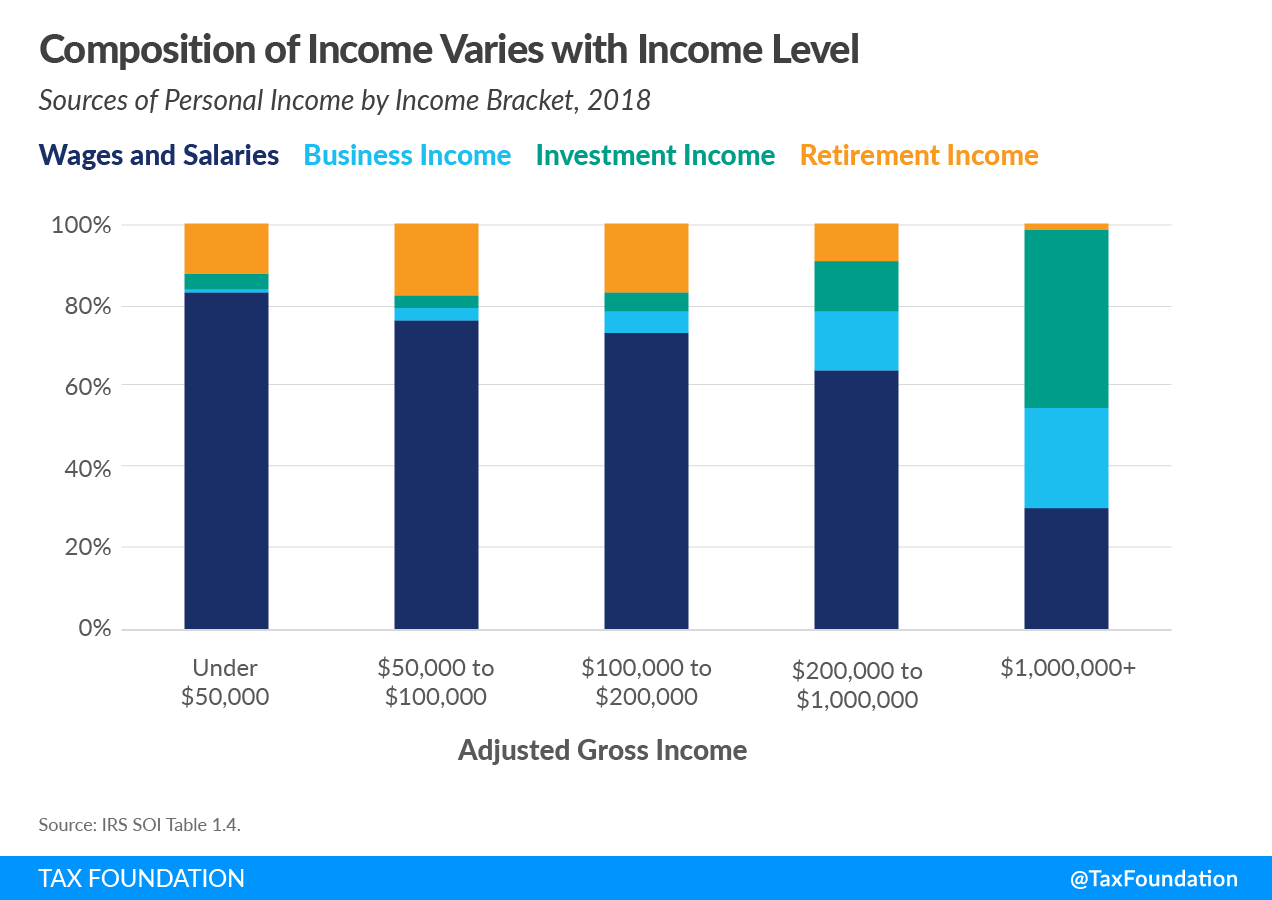

Sources Of Personal Income In The United States Tax Foundation

What Is The The Net Investment Income Tax Niit Forbes Advisor

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)